Political Corruption Is Responsible for $3 ATM Fees

How much does corruption cost you? When you use a non-network ATM, it’s usually a $3 fee, just for accessing your own money. The cost to the bank charging you that money, however, is just 37 cents. That’s price gouging, and when you add it all up, it’s a total of $7 billion annually that goes from those

Continue Reading >>>

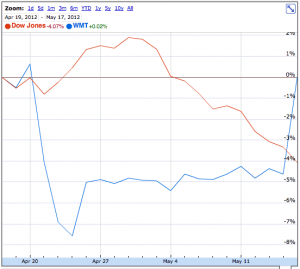

Crime Pays: Walmart Outperforms Dow by 4% Since Bribery Scandal Broke

On April 21, the New York Times’s David Barstow broke a major story about Walmart’s alleged extensive bribery in Mexico to expand its presence there. Yet, as you can see from the chart above, Walmart’s stock has recovered all of its value since the story, and it has outperformed the Dow by 4%. The threat

Continue Reading >>>

Filing Taxes Is Easy When Your Government Isn’t Bought By Intuit

The Republic Report’s story on how Intuit lobbies to make filing taxes annoying has sparked a fascinating conversation on Reddit. We still haven’t heard from the White House on why they haven’t implemented their campaign promise to make pre-filed tax forms a reality, but we did hear just how easy it is to file in other countries

Continue Reading >>>

Corruption Is Why You Can’t Do Your Taxes in Five Minutes

Here’s a chart of Intuit’s lobbying expenditures in Congress, courtesy of Open Secrets. I suspect that some of that nine million dollars of lobbying by that company since 2008 has gone to making it more annoying for you and me to file our taxes. Here’s what I mean. In some countries, the equivalent of their IRS

Continue Reading >>>

Corruption Responsible for 80% of Your Cell Phone Bill

Last year, a new company called Lightsquared promised an innovative business model that would dramatically lower cell phone costs and improve the quality of service, threatening the incumbent phone operators like AT&T and Verizon. Lightsquared used a new technology involving satellites and spectrum, and was a textbook example of how markets can benefit the public through competition.

Continue Reading >>>

At Banking Event, Senator-Turned-Lobbyist Evan Bayh Echoes Naomi Klein’s “Shock Doctrine,” Says Crisis is the Only Way to Make “Progress”

Ex-Senator Evan Bayh, a lobbyist for financial services industry firms like VISA (as well as many other corporate interests), spoke at an industry event late last year to give his thoughts on the political dynamic in the US. What he said could be lifted straight out of Naomi Klein’s book, “The Shock Doctrine”, whose thesis

Continue Reading >>>

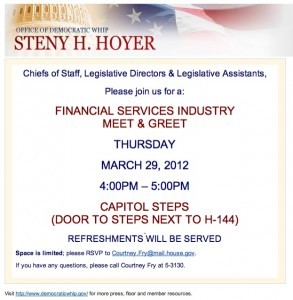

How You Can Meet Some Financial Services Lobbyists and the Staffers Who Love Them

Last week, you learned about former banking committee staffer Scott Eckel, who should just be settling into his new job as head of lobbying for Charles Schwab. Eckel is now earning money based on his connections crafted during his time as a public policy-maker, which is a nice clear a case of Backdoor Bribery. Below

Continue Reading >>>

Banking Committee Policy Advisor Scott Eckel: “I will begin work in my new role as Vice President, Legislative and Regulatory Affairs, at Charles Schwab & Co”

Just got this email. From: Eckel, Scott Sent: Wednesday, March 21, 2012 1:09 PM Subject: New Opportunity Friends and Colleagues — Wanted to let you all know that this Friday will be my last day with Chairman Garrett and the Capital Markets Subcommittee. As of Monday, March 26th, I will begin work in my new role as Vice

Continue Reading >>>